摘 要

本文使用动态随机一般均衡模型,估算在2024年经济社会发展主要预期目标下,我国以10年期国债收益率为代表的中长期利率锚均衡值的合意水平为2.49%,波动上限为2.81%,下限为2.17%。在“资产荒”背景下,本文研究测算匹配经济发展目标的基准利率合意水平值,从经济运行情况、成本收益分析及内外部市场扰动因素影响等方面,探讨均衡回归基础条件,得出利率锚波动上行回归均衡长期趋势的结论,通过释放利率锚波动方向信号,缓释市场风险,引导中长期资产价格回到合理水平区间,保障既定目标稳定顺利实现。

关键词

“资产荒” 10年期国债收益率 利率锚

引言

2024年5月,中国人民银行在一季度货币政策执行报告中提到,长期国债收益率是作为金融市场定价基准的国债收益率曲线的重要组成部分,主要反映长期经济增长和通胀预期。2024年以来,以10年期国债收益率为代表的中长期国债收益率持续下行,一定程度上受到了市场缺乏安全资产等因素的扰动。上半年,由于银行、保险等金融机构资产配置需求集中释放,投资者无风险资产需求上升,债券市场投资的需求相应增多,“资产荒”局面形成且短期内难以改善。在投资者追逐相对安全资产的大背景下,估算表征金融市场定价基准的10年期国债收益率的合意区间,引导中长期资产价格合理波动,缓释市场风险,就显得尤为迫切。

动态随机一般均衡模型(DSGE)基于微观主体的最优行为选择,能够有效分析宏观经济的运行机制,可以得到具有微观基础的宏观经济模拟结果。因此,本文从居民、企业家、金融部门等经济主体买卖国债的微观经济行为出发,考虑财政部门政府债券发行、中央银行货币政策操作等因素,以及国内、国外定价机制联动等情况,构建DSGE模型,以中债国债收益率数据为基础,使用贝叶斯(Bayesian estimation)技术,估算“资产荒”背景下,匹配既定经济增长目标的合意利率锚均衡水平及波动区间,为金融资产定价、财政政策和货币政策调整提供参考。

构建模型

本文以中债研究所课题成果《我国均衡利率估算和国债收益率曲线研究》为建模基础,构建包含家庭部门、企业家部门、金融机构部门、生产厂商部门、中央银行部门(货币政策)、政府机构(财政政策)、国外部门等7部门的DSGE模型。

(一)家庭部门

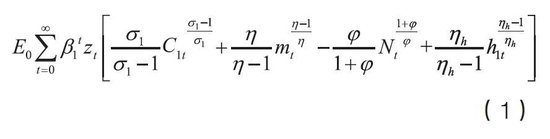

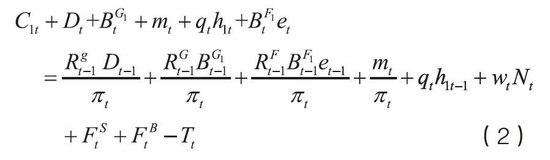

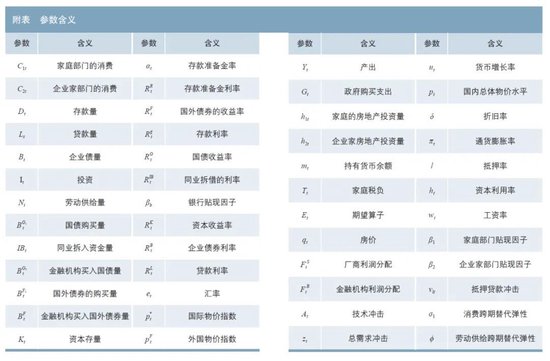

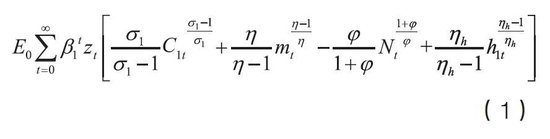

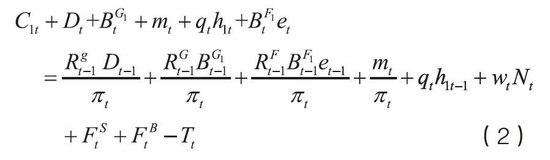

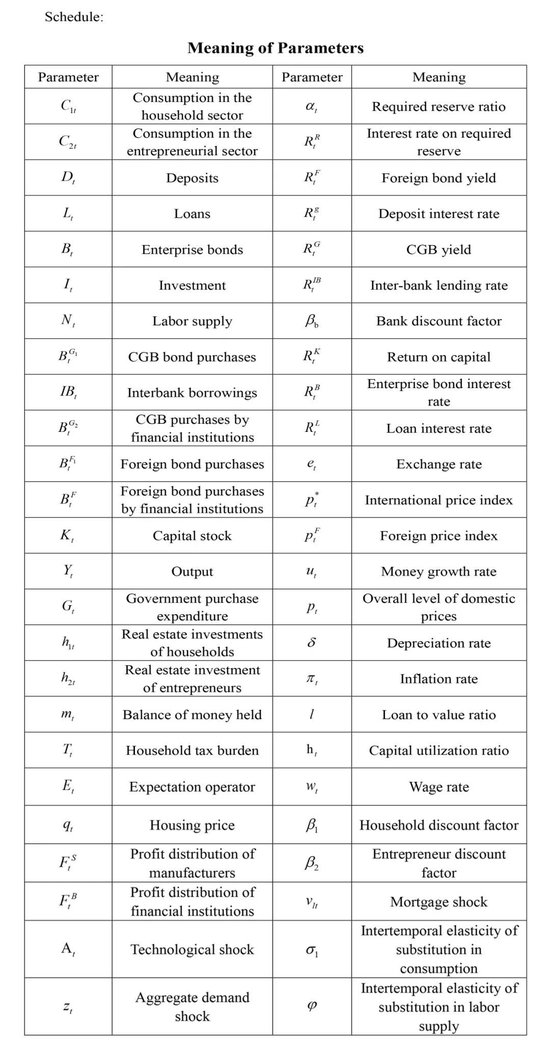

家庭部门最大化预期一生效用,效用函数为(1),约束条件为(2)。各字母对应含义统一在附表中列示。

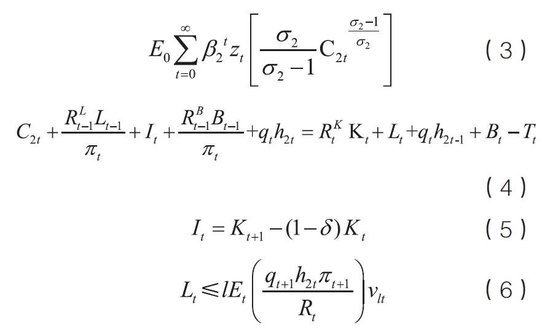

(二)企业家部门

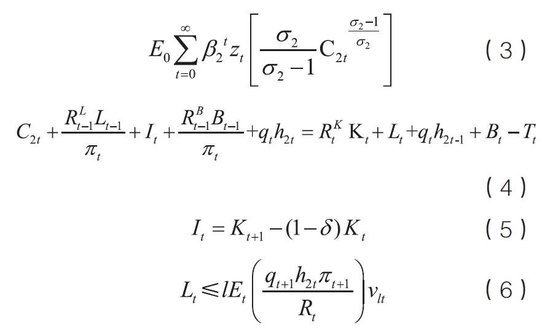

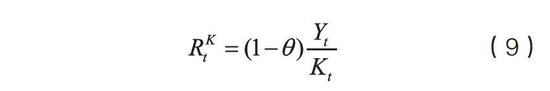

企业家最大化预期一生效用,效用函数为(3),约束条件为(4)(5)(6),通过债券发行和从银行贷款为投资(生产资本)融资。企业家把资本租给厂商,厂商雇用劳动力进行生产,企业家获得资本边际收益,厂商从生产中获益。

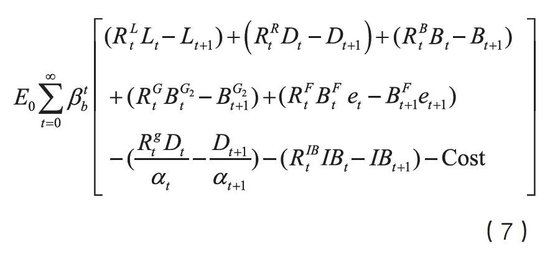

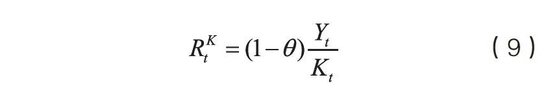

(三)金融机构部门

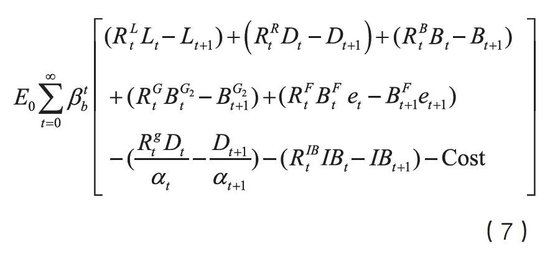

在金融机构货币创造资金流动方程基础上,可以得到目标函数(7),其中Cost为金融机构的管理成本,一般设定为二次函数形式,再结合无套利均衡条件,可以解得金融部门的最优行为方程式。

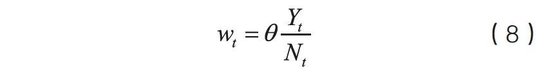

(四)生产厂商部门

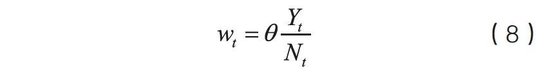

厂商追求利润最大化,优化可得:

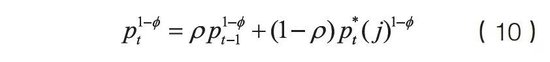

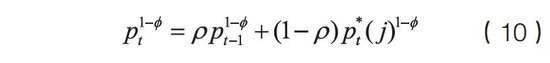

进而得到价格演进方程:

(五)中央银行部门

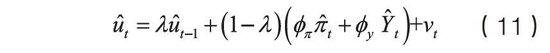

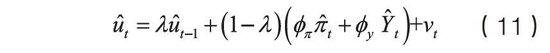

中央银行执行货币政策操作,假设遵循数量型规则,即:

内生化存款准备金率调整规则,设定存款准备金率行为方程,同时考虑存款准备金利率调整模式,即可得到中央银行部门的行为方程组。

(六)政府部门

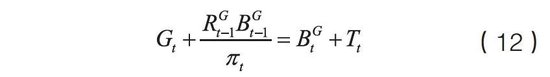

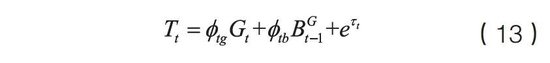

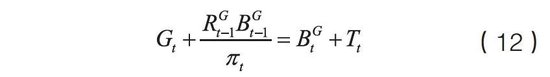

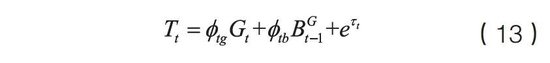

政府部门预算收支平衡,即:

(七)国外部门

模型设定我国为开放型经济体,境内资产价格、资本价格水平受到境外经济体影响,按照一价定律、利率平价理论:

包括我国在内的世界金融市场均衡条件:

结合开放经济的约束条件,可以得到开放经济条件下的最优行为方程。

设定冲击方程,各市场同时出清,将各模块最优一阶条件和约束条件整合匹配,综合可得本文DSGE模型方程组体系。

模拟估算

(一)数据处理

本文使用近10年数据,区间为2014年至2023年,频率为季度,选取国内产出、通货膨胀、货币供应量、债券收益率、房屋价格等五个内生变量为观测变量,基于万得(Wind)数据库,使用国内生产总值(GDP)、居民消费价格指数(CPI)、广义货币(M2)、中债国债收益率、房价指数等数据作为基础数据。

2024年《政府工作报告》提出,今年发展主要预期目标是GDP增长5%左右,CPI涨幅为3%左右。基于此,本文设定2024年GDP、CPI合意增长率分别为5%、3%,将M2的合意增长率设定为8%(GDP预期增长率加CPI预期增长率),房价预期下降幅度控制在1%以内,可以得到本文完整季度频率数据,据此估算2024年利率锚均衡水平的合意值。

(二)模拟估计

从模型模拟特征看,模型准确捕捉到了GDP、CPI、M2等关键内生变量的波动特征。模型模拟经济中内生变量一阶自相关系数变动特征也与实际经济较为相近,因此可以判断本文动态随机一般均衡模型模拟经济的有效性。

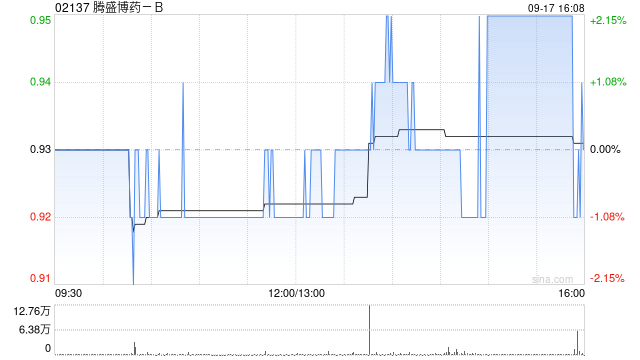

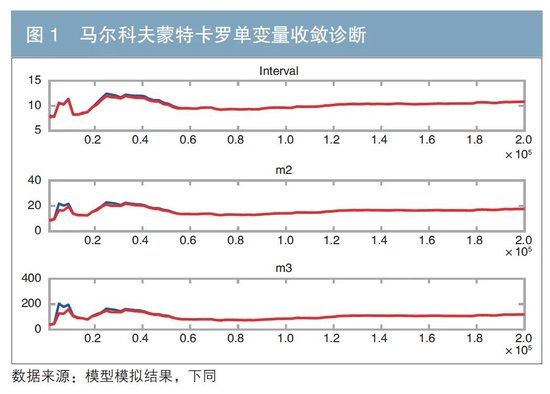

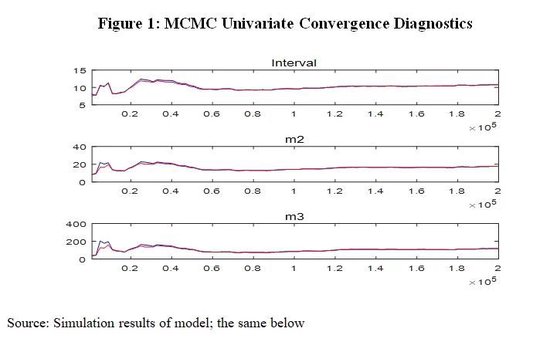

从模型估计特征看(见图1),马尔科夫蒙特卡洛单变量收敛诊断(MCMC收敛诊断)图可以说明本文所有参数估计结果的有效性。

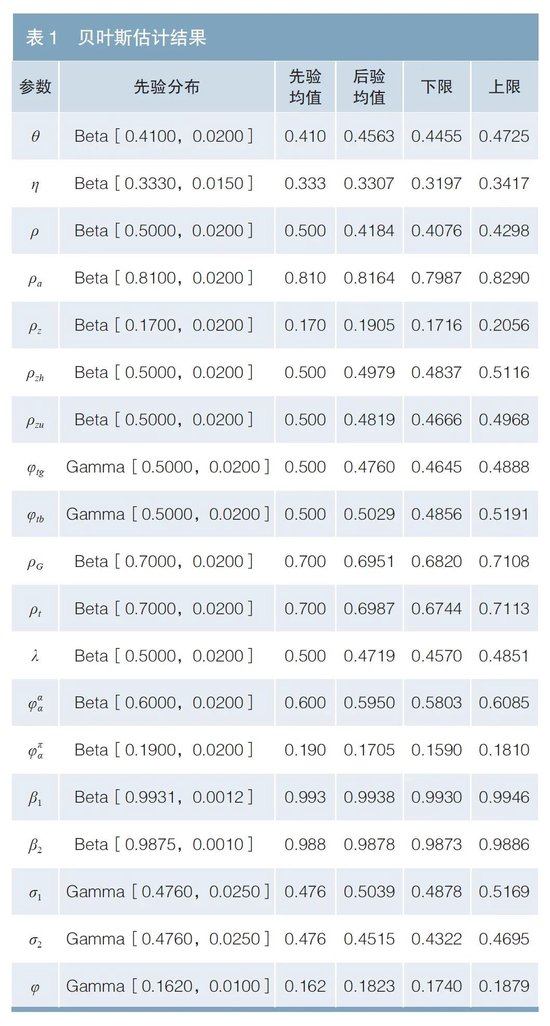

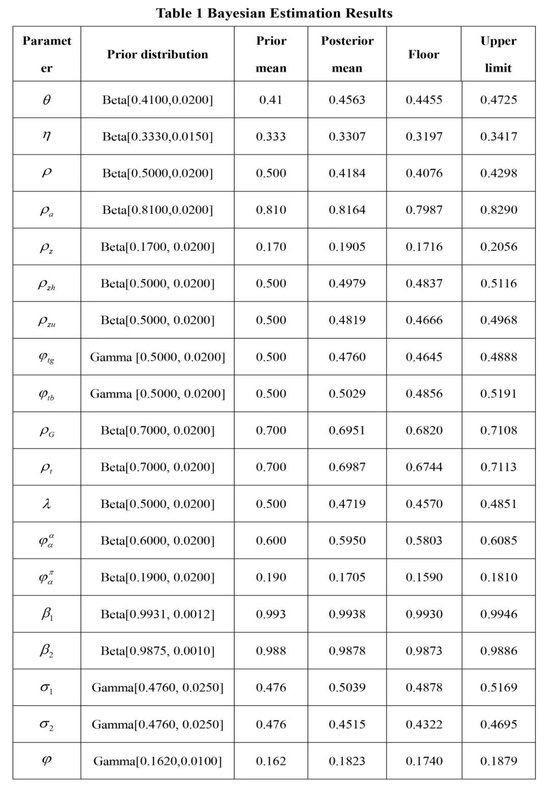

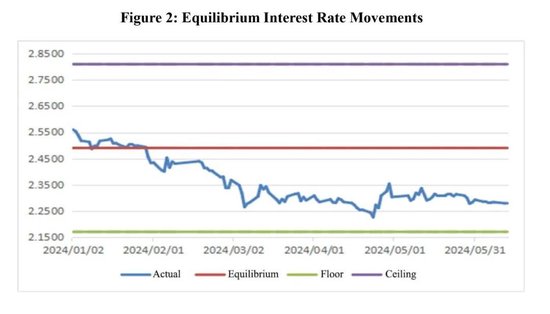

从均衡利率估算具体数值特征看,根据参数的贝叶斯估计结果(见表1),可以模拟计算出利率锚的均衡值水平为2.49%,均衡值波动上限为2.81%,均衡值波动下限为2.17%。今年以来,利率锚实际运行值与均衡值区间对比如图2所示。

结果分析

自2024年以来,从10年期国债收益率的实际运行情况看,只有1月在均衡值水平上方波动;2月初向下跌破均衡值之后,在均衡值水平附近波动一个月左右;3月即开始加速向下,持续偏离均衡水平向下波动;4月底下探之后逐渐向均衡水平回归;6月又表现出渐次偏离均衡水平的趋势。最新数据(6月14日)显示,10年期国债收益率为2.2558%,较均衡水平低约23BP。从整体看,年初以来,10年期国债收益率平均值为2.36%,较均衡水平低13BP。具体来看,今年经济实际运行情况、10年期国债收益率下降的边际效应,以及内外部市场扰动因素等方面,以10年期国债收益率为代表的利率锚具备向上进行均衡回归的条件。

(一)从经济运行情况来看,利率锚逐渐向上回归均衡水平有数据支撑

一季度GDP增长率为5.3%,经济运行结果好于预期,CPI温和回升,工业生产者出厂价格指数(PPI)降幅减小,采购经理指数(PMI)生产指数处于扩张区间,说明前期政策效果正在持续显现。当前,10年期国债收益率持续偏离均衡水平,大幅低于合意目标值,中长期资产价格风险凸显,市场情绪波动较大,资产价格的大幅波动可能影响到人民币币值稳定和我国今年经济增长目标的实现。尽管市场中利率已处于较低水平,继续向下的压力较大,但货币政策操作仍有空间,未来也不排除降息降准的可能。货币政策主要压力已转向强化逆周期和跨周期调节,抑制经济非理性大幅波动,更好地保障经济平稳健康发展。考虑到一季度经济数据强于预期,货币政策操作应更具灵活性,通过预期引导、公开市场操作等,调节基准利率回归均衡水平,稳定资产价格,防范化解金融风险。

(二)从边际效应看,利率锚偏离均衡水平继续下行成本远超收益

2023年以来,作为长期存款利率锚的10年期国债收益率持续下行,带动存款利率不断下降,在维持银行净息差,留足贷款利率下调空间,降低实体经济融资成本,为经济发展提供宽松货币金融环境方面发挥了重要作用。但银行通过手工补息等方式高息揽储,提高负债成本的情况仍普遍存在,在一定程度上影响了银行净息差。公开数据显示,2024年一季度银行业平均净息差来到1.54%的低位,已低于维持利润的合理区间,可能会影响到银行业服务实体经济的稳定性和可持续性。因此,4月以来,监管部门和市场自律机构纷纷引导压低商业银行发债成本,明确严禁手工补息高息揽储,阻止净息差继续下降。另外,存款利率下降空间已经十分有限,再通过降低10年期国债收益率带动存款利率下行的边际作用较小,而由此导致由市场承受的边际成本却比较大,可见10年期国债收益率已无持续下降的政策基础。

(三)从内外部市场扰动因素看,利率锚均衡回归是大概率事件

一是“资产荒”情况会不断得到缓解。今年以来,10年期国债收益率持续下行,也受到市场中长期优质资产缺乏因素的影响。今年政府债券发行总量目标较大,遵循既定的发行节奏,上半年长期债券品种供给速度低于预期,市场长期优质资产紧张。此外,由于地方债发行进度放缓,市场中一部分计划配置地方债的资金流向国债市场,国债收益率不断降低,多因素叠加,导致出现超长期特别国债发行受到市场追捧、交易所市场非理性交易等情况,预期“异常现象”会随着下半年中长期国债、地方债等发行提速的出现而逐渐消失。二是中美利差为均衡回归提供助力。今年以来,中国10年期国债收益率与美国10年期国债收益率持续倒挂,利差不断扩大,6月14日利差达194BP,国际资本逐利流动,人民币汇率承压较大。从稳定汇率的角度看,一定程度上会将压力反向传导至10年期国债收益率,促进均衡回归,即通过提高境内无风险资产收益率水平,一方面吸引国际资本稳定投资境内市场,另一方面减小资本流出压力,维护汇率稳定。

从本文模拟中可以看出,当前利率锚在均衡水平下方波动,短期内回归到均衡值水平的压力较大,但市场基准与政策目标之间的利差水平,也为财政政策、货币政策操作调整稳定市场提供了一定的参考。从长期来看,利率锚回归均衡值的内生动力较足、外部助力较强,通过释放基准利率向上回归均衡水平的信号,带动其他收益率指标稳步提升,引导长期资产价格回归合理区间,以较小的政策调整成本,实现助力防范化解重大金融风险的目标。

参考文献

[1] 李威. 存款利率市场化改革背景下的长期利率锚研究[J]. 债券,2022(8):51-56. DOI: 10.3969/j.issn.2095-3585.2022.08.013.

[2]尹雷,丁烨,吴静. “低利率”环境下财税政策调控效能检验与结构性政策工具选择[J]. 财贸研究,2023,34(10): 73-84.

[3]朱长法. 加强商业银行债权投资利率风险管理 促进债券市场高质量发展[J]. 债券,2024(1):7-11. DOI: 10.3969/j.issn.2095-3585.2024.01.003.

◇ 本文原载《债券》2024年7月刊

◇ 作者:中央结算公司客服中心 李威

◇ 编辑:鹿宁宁

Research on Target Value of Long-term Interest Rate Anchor under the Background of “Asset Crunch”

Li Wei

Abstract

In this paper, the dynamic stochastic general equilibrium (DSGE) model is used to estimate that, given China’s annual targets for economic and social development in 2024, the desirable equilibrium value of China’s medium- and long-term interest rate anchors represented by the 10-year China Government Bond (CGB) yield is 2.49%, with a ceiling of 2.81% and a floor of 2.17%. Under the background of “asset crunch”, this paper studies and calculates the desirable value of the benchmark interest rate matching the economic development targets, discusses the basic conditions for equilibrium regression from the perspectives of economic performance, cost-benefit analysis and the impact of internal and external market disturbance factors and draws the conclusion that the interest rate anchor will fluctuate upwards and return to the equilibrium long-term trend. By releasing the signals of interest rate anchor movements going forward, the market risk will be mitigated, and the medium- and long-term asset prices will be guided back to a reasonable range to ensure the steady and smooth realization of preset targets.

Keywords

“Asset crunch”, 10-year CGB yield, interest rate anchor

Foreword

In May 2024, the People’s Bank of China (PBOC) noted in its monetary policy implementation report for the first quarter that the long-term China Government Bond (CGB) yield is a crucial part of the CGB yield curve serving as a pricing benchmark in the financial market, and mainly reflects long-term economic growth and inflation expectations. In 2024 to date, the long-term CGB yield represented by the 10-year CGB yield has been moving downwards, partly due to disturbance from such factor as the lack of safe-haven assets in the market. In the first half of the year, investors had growing demand for risk-free assets amid intense release of asset allocation demand from banks, insurers and other financial institutions. The demand for bond market investment increased accordingly, resulting in an “asset crunch” that can hardly be eased in the near term. In the context of investors chasing safe-haven assets, it is particularly urgent to estimate the desirable range of the 10-year CGB yield, which represents the pricing benchmark of the financial market, to guide the reasonable fluctuations of medium- and long-term asset prices and mitigate market risks.

Dynamic stochastic general equilibrium (DSGE) models are based on the optimal behavior selection of micro-agents, effective in analyzing the operating mechanism of macro-economy and getting micro-founded macro-economic simulation results. Therefore, this paper builds a DSGE model based on the microeconomic behaviors of economic agents such as households, entrepreneurs and financial sector in buying and selling CGBs, taking into account such factors as government bond issuance, monetary policy operations, and the interactions between domestic and foreign pricing mechanisms. Using the Bayesian estimation, we estimate the desirable equilibrium level and fluctuation range of interest rate anchors matching the economic growth targets under the background of “asset crunch”, providing a point of reference for the pricing of financial assets and the adjustment of fiscal and monetary policies.

Construction of Model

In this paper, the research results of the ChinaBond Research Institute, titled “A Research on Interest Rate Anchor during the Deposit Rate Liberalization Reform”, are taken as the basis to construct a DSGE model that covers seven sectors, namely, households, entrepreneurs, financial institutions, manufacturers, central bank (monetary policy), government agencies (fiscal policy) and foreign sector.

i. Households

The household sector maximizes expected lifetime utility with utility function (1) and constraint (2). The meanings of relevant letters are shown in the Schedule attached.

ii. Entrepreneurs

The entrepreneurs maximize the expected lifetime utility with the utility function (3) and constraints (4), (5) and (6), funding their investments (production capital) by issuing bonds and borrowing from banks. The entrepreneurs lease the capital to manufacturers, which employ the labor force to produce products. The entrepreneurs earn a marginal return on the capital, and the manufacturers benefit from the production.

iii. Financial institutions

An objective function (7) can be obtained based on the money creation flow-of-funds equation of financial institutions, where Cost is the management cost of financial institutions. It is generally set as a quadratic function. With the condition of no-arbitrage equilibrium in place, the optimal behavior equation of the financial sector can be solved.

iv. Manufacturers

Manufacturers seek to maximize profits. After optimization, we will get:

Then a price evolution equation is obtained:

v. Central bank

The central bank performs monetary policy operations. Assuming that quantitative rules are followed:

The behavioral equations of the central bank can be obtained by internalizing the required reserve ratio (RRR) adjustment rules, setting the RRR behavior equation and considering the RRR interest rate adjustment mode.

vi. Government

The government sector has a balanced budget:

vii. Foreign sector

The model assumes that China is an open economy, and domestic asset prices and capital prices are influenced by overseas economies. According to the law of one price and the theory of interest rate parity:

Equilibrium conditions of the global financial market including China:

Taking into account the open economy constraints, the optimal behavior equation under the open economy condition can be obtained.

With the shock equation set, all markets cleared at the same time and the optimal first-order conditions and constraints of each module integrated and matched, we can get a system of DSGE model equations in this paper.

Simulation-based Estimation

i. Data processing

This paper uses the data in the past 10 years ranging from 2014 to 2023, with a quarterly frequency. Five endogenous variables, namely, domestic output, inflation, money supply, bond yield and housing price, are selected as observed variables. Based on the Wind database, the gross domestic product (GDP), consumer price index (CPI), broad money (M2), CGB yield, and housing price index are used as basic data.

According to the Government Work Report for 2024, China’s targets for the year are GDP growth of about 5.0% and CPI increase of about 3%. On that basis, the desirable growth rate of GDP and CPI in 2024 is set at 5% and 3% respectively, the desirable growth rate of M2 is set at 8% (the expected growth rate of GDP plus the expected growth rate of CPI), and the expected decline rate of housing prices is controlled within 1%, so that the complete quarterly data can be obtained in this paper as the basis for estimating the desirable equilibrium of the interest rate anchor in 2024.

ii. Simulated estimation

From the perspective of model simulation characteristics, the model accurately captures the fluctuation characteristics of key endogenous variables such as GDP, CPI and M2. The first-order autocorrelation coefficients of endogenous variables in the economy simulated by the model show similar change characteristics to those in the real-world economy, evidencing the effectiveness of the DSGE model in simulating the economy in this paper.

From the model estimation features (see Figure 1), the Markov Chain Monte Carlo univariate convergence diagnostics (“MCMC Convergence Diagnostics”) diagram can illustrate the validity of all parameter estimation results in this paper.

As for the specific numerical characteristics of the equilibrium interest rate estimates, according to the Bayesian estimation results of the parameters (see Table 1), the equilibrium level of the interest rate anchor can be simulated and calculated at 2.49%, with its movements subject to a ceiling of 2.81% and floor of 2.17%. The actual value versus equilibrium value of the interest rate anchor in 2024 to date are shown in Figure 2.

Analysis of Results

As shown by the actual movements of the 10-year CGB yield in 2024 to date, only January saw movements above the equilibrium level. After falling below the equilibrium level in early February, the yield fluctuated around the equilibrium for about a month. It began to move lower faster in March, showing continuing downward fluctuations away from the equilibrium level. After touching a low in late April, the yield gradually returned to the equilibrium level. In June, it showed a trend of gradually deviating from the equilibrium. The latest data (June 14) showed the 10-year CGB yield at 2.2558%, about 23bps below its equilibrium level. On the whole, the average 10-year CGB yield was 2.36% in 2024 to date, 13 bps below the equilibrium level. Specifically, in terms of the actual economic performance this year, the marginal effect of the 10-year CGB yield decline and internal and external market disturbance factors, the interest rate anchor represented by the 10-year CGB yield is ready to move higher and return to the equilibrium.

i. From the perspective of economic performance, data supports a gradual return of the interest rate anchor to its equilibrium level

In the first quarter, the GDP growth rate was 5.3%, and the economic performance was better than expected, the CPI picked up moderately, the decline of the producer price index (PPI) slowed down, and the purchasing managers index (PMI) was in the expansion range, indicating that the earlier policies continued to work. At present, the 10-year CGB yield continues to deviate from the equilibrium level, significantly lower than the desirable target value. The price risk of medium- and long-term assets has become prominent, and market sentiments are volatile. The wide fluctuations in asset prices may destabilize the RMB value and have an adverse effect on China’s push for its economic growth target. The market interest rate is already low but still under significant downward pressure. However, there is still room for monetary policy operations, and further cutting interest rates and RRR are still possible going forward. The main pressure on monetary policy has shifted to strengthening counter-cyclical and cross-cyclical adjustments, curbing irrationally wide economic fluctuations and better ensuring steady and healthy economic growth. Taking into account the stronger-than-expected economic data in the first quarter, monetary policy operations should be more flexible, so as to bring the benchmark interest rate back to the equilibrium level through the guidance of expectations and open market operations, stabilize asset prices and forestall and defuse financial risks.

ii. From the perspective of marginal effect, the interest rate anchor deviates from the equilibrium level and the cost far exceeds the benefit

Since 2023, the 10-year CGB yield as the interest rate anchor for long-term deposits has been on the decline, driving the deposit rates lower. It plays a crucial role in maintaining banks’ net interest margin (NIM), leaving enough room for lending rate reduction, reducing the financing cost of the real economy and providing an easy monetary and financial environment for economic development. However, it is still common for banks to attract deposits with higher interest rates and increase the cost of liabilities through manual interest compensation, which increases the cost of liability and weakens the NIM of banks. Publicly available data shows that the average NIM of the banking industry in the first quarter of 2024 came to a low of 1.54%, below the reasonable range necessary to remain profitable, which may affect the stability and sustainability of banking services for the real economy. Since April, therefore, regulatory authorities and self-regulatory organizations have guided commercial banks to lower the cost of issuing bonds and clearly prohibited the competition for deposits with higher interest rates by means of manual interest compensation, thereby preventing any further decline in NIM. In addition, there is very limited space for further deposit rate cuts, and lowering the 10-year CGB yield will have a weak margin effect in driving deposit rates downwards, while the marginal cost borne by the market participants is relatively high. It is obvious that there is no policy basis for continued drops in the 10-year CGB yield.

iii. From the perspective of internal and external market disturbance factors, interest rate anchor will likely return to equilibrium

First, the “asset crunch” will be gradually eased. The 10-year CGB yield has been moving lower since the beginning of 2024, partly due to the lack of medium- and long-term high-quality assets in the market. China has planned a large size of government bond issuance this year. With the issuance paced as scheduled, the supply of long-term bonds was slower than expected in the first half of the year, and the market is tight in long-term high-quality assets. In addition, given the slowdown in the issuance of local government bonds, some funds originally targeted at local government bonds have been diverted toward the CGB market, driving the CGB yield lower. With various factors combined, the ultra-long-term special CGBs have been much sought after among market participants, giving rise to irrational transactions in the exchange market. It is expected that the unusual market activity will fade away as the issuance of medium- and long-term CGBs and local government bonds will be accelerated in the second half of the year. Second, the China-US interest rate spread gives a boost to the return to equilibrium. Since the beginning of this year, the 10-year CGB yield and the US 10-year Treasury yield have remained inverted, and the spread has been expanding to reach 194 bps on June 14. The resultant international capital flows put RMB exchange rate under great pressure. From the perspective of stabilizing exchange rate, the pressure will, to some extent, be transmitted to the 10-year CGB yield and drive a return to equilibrium. That is, by increasing the yields on domestic risk-free assets, international capital will be attracted and retained in the domestic market, and the capital outflow pressure will be eased to keep exchange rate stable.

It can be seen from the simulation in this paper that the current interest rate anchor fluctuates below the equilibrium level, under significant pressure of returning to equilibrium in the short term. However, the spread between the market benchmark and the policy target also provides a certain reference for fiscal policy and monetary policy adjustments to stabilize the market. In the long run, there is strong endogenous driving force and external support for the interest rate anchor’s return to the equilibrium. By releasing the signal of the benchmark interest rate returning to equilibrium, other yield indicators will be driven steadily higher, and long-term asset prices will be guided back to a reasonable range, so as to successfully forestall and defuse major financial risks at a low cost of policy adjustments.

This article was first published on Bond Monthly ( Jul. 2024).Please indicate the source clearly when citing this article. The English version is for reference only, and the original Chinese version shall prevail in case of any inconsistency.

References

[1] Li Wei. Research on Long-term Interest Rate Anchor under the Background of Deposit Rate Liberalization[J]. China Bond, 2022(8): 51-56. DOI: 10.3969/j.issn.2095-3585.2022.08.013.

[2] Yin Lei, Ding Ye, Wu Jing. Effectiveness Test of Fiscal and Tax Policy Regulation and Choice of Structural Policy Tools under the “Low Interest Rate” Environment [J]. Finance and Trade Research 2023, 34(10): 73-84.

[3] Zhu Changfa. Strengthening Interest Rate Risk Management of Debt Investments of Commercial Banks, Promoting High-quality Development of the Bond Market [J]. China Bond, 2024(1):7-11. DOI: 10.3969/j.issn.2095-3585.2024.01.003.

◇ Author from: CCDC Customer Service Center

◇ Editor: Lu Ningning